Aviation & Aerospace Products Liability Insurance for manufacturers and MROs

Coverage for risks tied to parts and work

Liability coverage for aviation products and components

Aviation Products Liability protects manufacturers, suppliers, and maintenance providers if a part or completed operation/service is alleged to cause injury or property damage. General business policies typically exclude aircraft products, so specialized coverage is essential for aerospace exposures. JCL Aviation Services structures programs for various size companies providing components, parts, and services to the aviation & aerospace industry. Whether you provide mobile maintenance or manufacture drones, JCL Aviation Services can help.

Who needs this coverage

Manufacturers, suppliers, distributors, and repair organizations

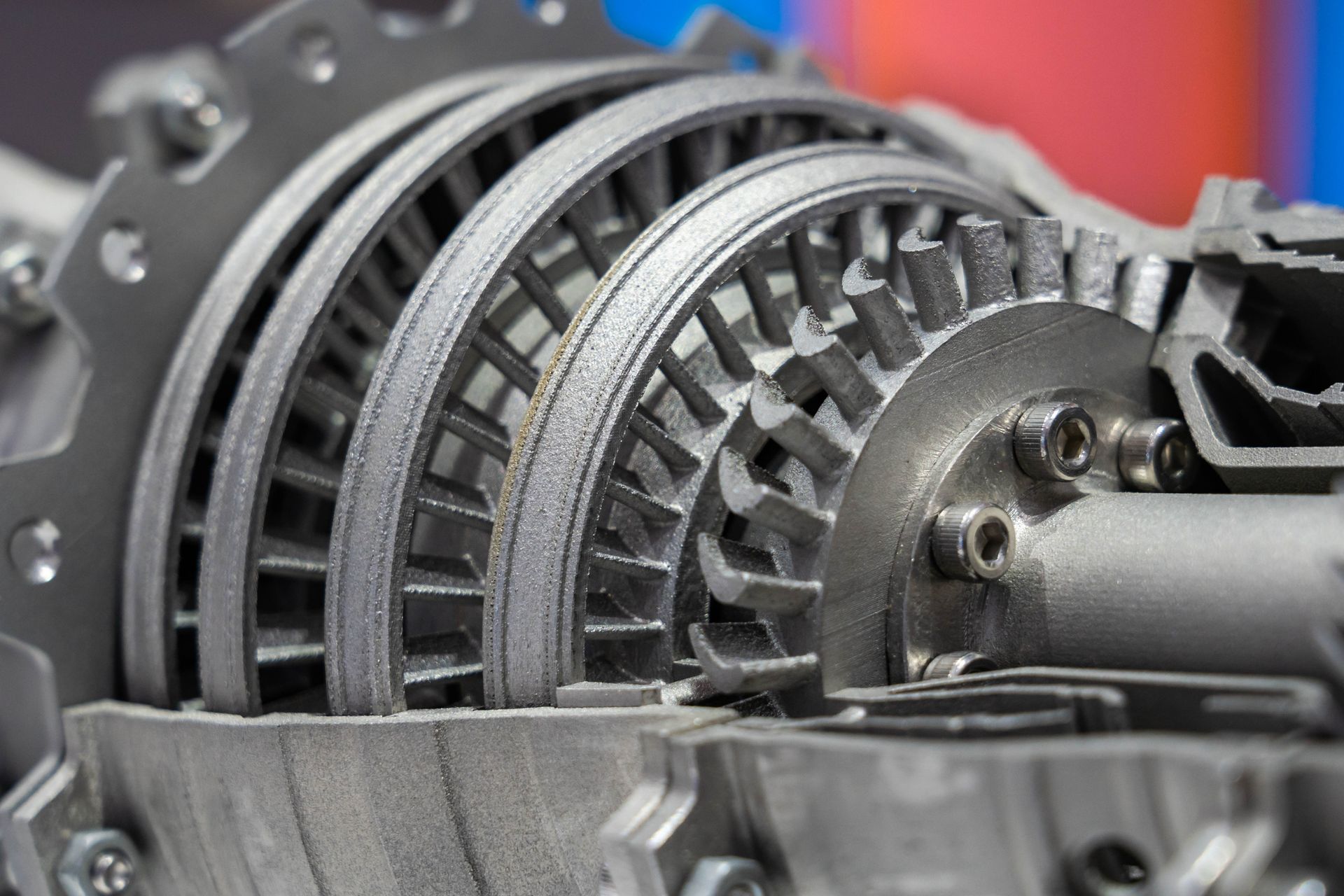

Companies producing aircraft parts, avionics, interiors, engines, or supplying materials that become part of an aircraft or spacecraft have an aviation product exposure as do companies who manufacture equipment used in aviation operations such as a towbar. Distributors and retailers in the supply chain can also be named in litigation after an incident. MROs and repair stations face similar risk because faulty work can be treated as a product in many claims.

Core policy features

Third-party liability, legal defense, and grounding

Third-party liability responds to bodily injury and property damage claims linked to your product or completed work. Legal defense costs are included and essential because aerospace litigation is complex and expensive even when allegations are unproven. Grounding liability provides coverage for financial losses which may arise if a defect or safety issue associated with your component leads to an airworthiness directive rendering aircraft idle.

How JCL Aviation Services helps

Contract compliance, fit-for-purpose limits, and clear terms

We review OEM and customer contracts for required limits, additional insured provisions, and other insurance requirements. JCL Aviation Services explains coverage details including exclusions, so coverage intent matches your exposures. Our market access helps match underwriters to your profile, whether you serve GA aircraft, corporate jets, or UAV platforms.

Questions aerospace companies ask

Practical answers for manufacturers and MROs

We already carry general liability. Do we still need aviation products liability?

Most general liability policies exclude aviation products. If your parts can end up in an aircraft or be used in conjunction with an aircraft, you need a dedicated aviation products policy. Without it, your business could face uncovered defense costs and judgments.

What limits are typical for suppliers?

Smaller component producers may start with limits in the single-digit millions, while major suppliers often carry much higher amounts. We align recommendations with contract language, product criticality, and your risk tolerance. JCL works with your team to meet goals & obtain comprehensive coverage at competitive prices.

Does this cover work we performed years ago?

Aviation products policies address long-tail exposure, but coverage depends on occurrence versus claims-made terms. We document your sales periods and policy history to avoid gaps. Proper recordkeeping helps claims proceed smoothly.

Are distributors and resellers really at risk?

Yes, plaintiffs often name everyone in the supply chain after an accident. Distributors need protection even if they did not manufacture the part. A product policy helps fund defense and potential settlements.

Can we combine products liability with other coverages?

Some insurers package products with general liability for aviation businesses, but a separate policy may be required based on carrier and exposure. We coordinate your AGL, property, and workers comp policies to avoid overlaps and gaps in coverage. Our goal is a cohesive program that responds predictably.